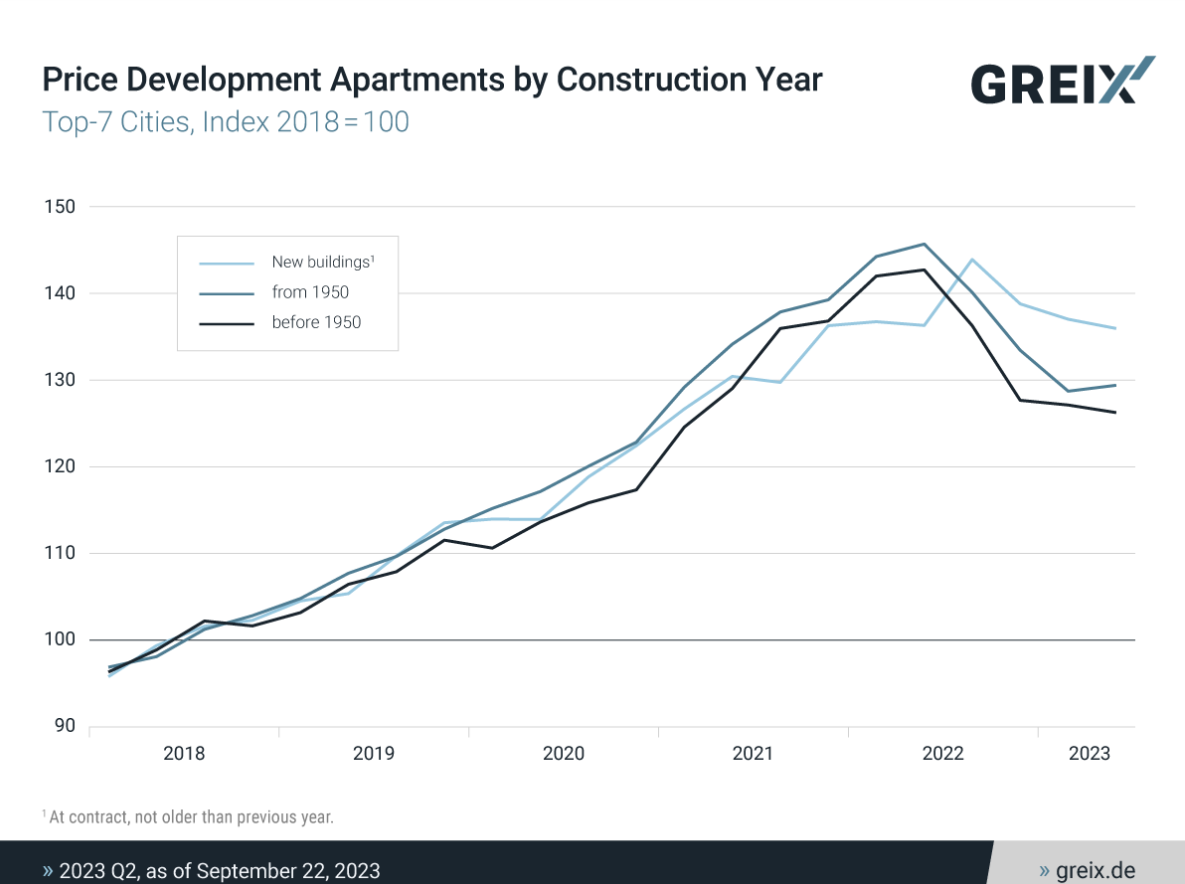

A recent analysis of the German Real Estate Index (Greix) shows that prices for new apartments in the country’s top 7 cities (Berlin, Duesseldorf, Frankfurt a. M., Hamburg, Cologne, Munich, Stuttgart) have experienced a relatively moderate decline of 5.5 percent on average compared to their peak levels.

Beginning in 2018, new building prices saw a robust increase of 45 percent by Q3 2022. This growth slowed to 37 percent in Q2 2023. This means that prices of new buildings in the past quarter roughly matched the levels seen at the beginning of last year.

The slump is much more pronounced for existing properties in the top 7 cities, subdivided into construction years before and from 1950. Prices for both classic old buildings and apartments built after World War II peaked as early as Q2 2022, and for both segments sales prices were down a good 12 percent in Q2 2023. Thus, prices returned to levels seen at the start of 2021.

“Prices of new apartments have shown resilience in the face of significant market price declines,” says Jonas Zdrzalek, lead researcher at Greix. “This could be attributed to sellers’ reluctance to discount prices. Also, sales prices are often pre-negotiated before project completion, so interest rate increases may not be fully reflected in current prices. Moreover, the supply of newly constructed apartments has significantly decreased, and the few projects that are being carried out are typically very expensive.”

The Greix data highlights a substantial decline in market activity. The number of apartments sold in the top 7 has plummeted by over 50 percent quarter-on-quarter compared with the boom phase in 2021. This decline is particularly pronounced in the new construction sector, where the number of sales has dropped by over 80 percent. Transactions for all construction years have been in a steady decline since 2022.

Due to the relatively low number of transactions, evaluating real estate prices by the year of construction for individual cities currently yields highly volatile results. Therefore, this data is aggregated solely for all top 7 cities. Data for Munich is available only up to Q1 2023.

Already on August 3rd, Greix data for the 2nd quarter of 2023 was released, including data for individual cities (Greix: Real estate prices in Germany stabilize).

The report reveals that real estate prices have stabilized compared to the previous quarter Q1 2023. Apartments experienced only a slight decrease of -0.3 percent. Single-family houses (+2.4 percent) and multi-family houses (+1.8 percent) have even seen increases. Particularly in Berlin and Cologne prices have already started to rise again. However, compared to the same quarter in the prior year (Q2 2022), all segments have witnessed significant declines.

The real estate prices for Q3 2023 will be made available in early November 2023.