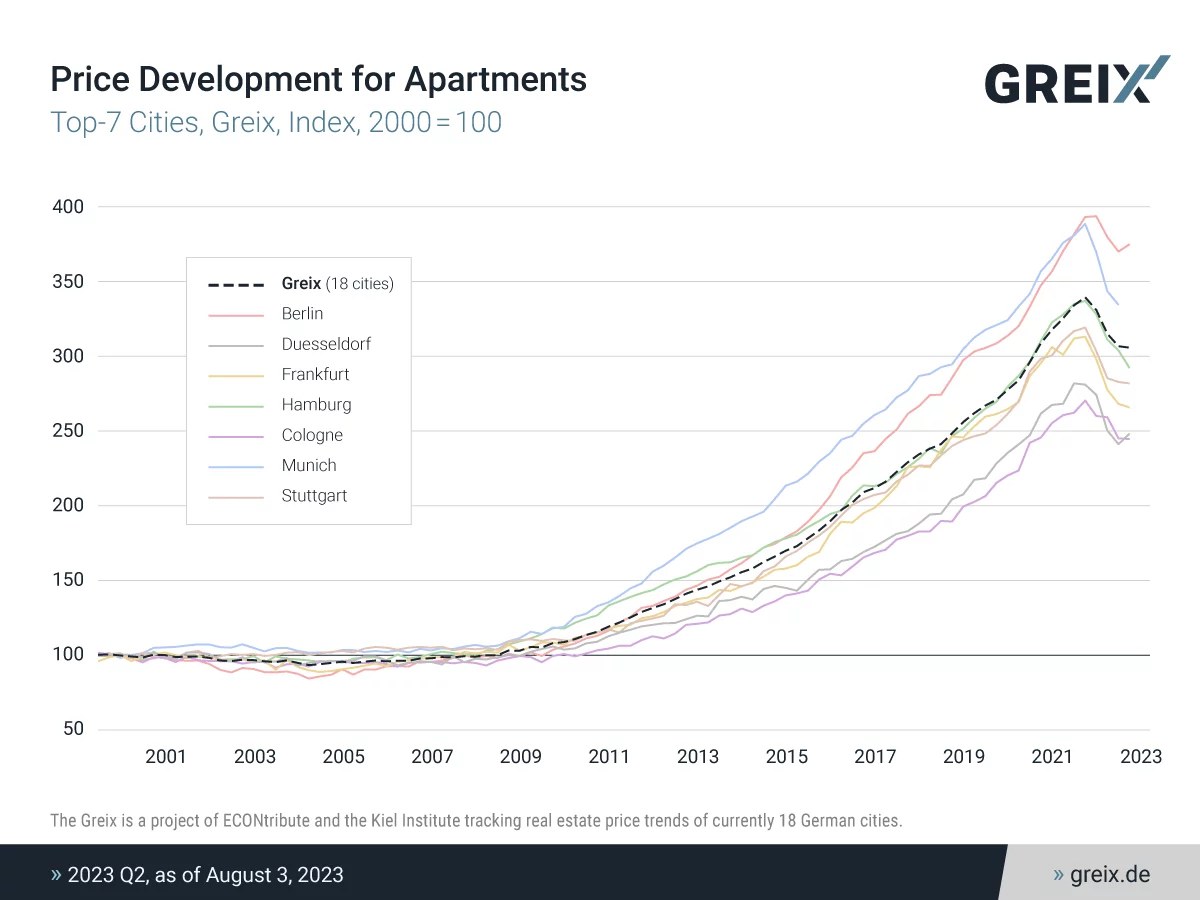

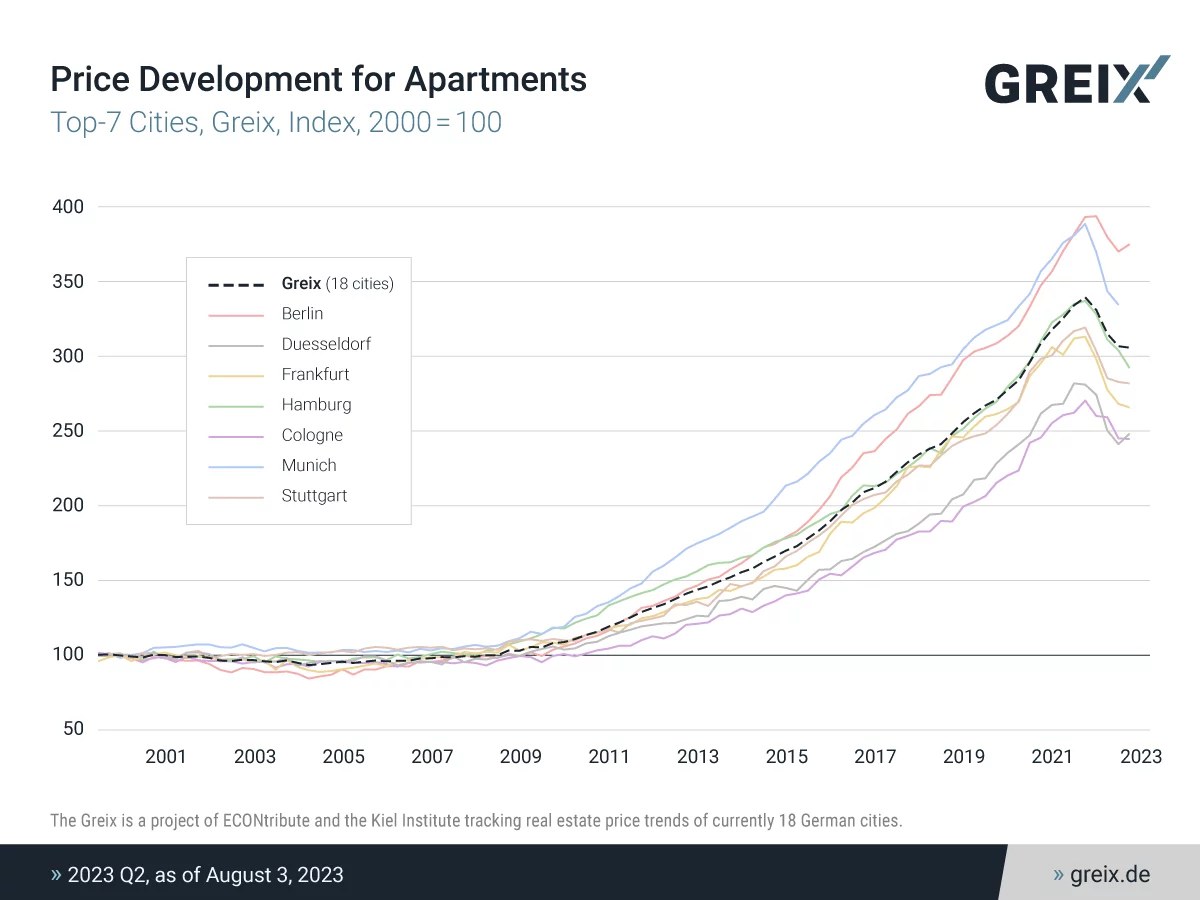

The Greix (German Real Estate Index) is a real estate price index for Germany based on actual, notarized sales prices. It tracks the price development of individual cities and neighborhoods back to 1960 and is based on more than two million transaction data. The dataset can be used to analyze long-term trends in real estate markets and to contextualize current developments in a historical context.

According to the latest update of the Greix, house prices have now bottomed out from the price correction and are picking up again compared with the previous quarter. Prices for apartments are declining, but only slightly and with wide regional heterogeneity. Here, too, rising prices can be observed again in some cities.

Compared with the previous quarter, Q1 2023, prices for apartments decline by 0.3 percent. Single-family house prices increase 2.3 percent, while multi-family house prices increase 1.8 percent. Also inflation-adjusted, only apartments prices decline (-1.5 percent), while singlefamily house prices (+1.1 percent) and multi-family house prices (+0.5 percent) are up when measured in current purchasing power.

Compared with the previous-year quarter, Q2 2022, all housing segments are still down sharply. Apartments prices are down 9.9 percent in comparison, single-family house prices are down 10.5 percent, and multi-family house prices are down 20.9 percent.

"The German real estate market proved to be quite robust in the second quarter. The expectation that the European Central Bank's interest rate hikes will gradually come to an end has clearly done the real estate market good after the significant price corrections of recent months," says Moritz Schularick, President of IfW Kiel. "The fact that real estate prices are stabilizing even when adjusted for inflation is a positive signal for the economy."

Top-7 Cities:

Prices for apartments in Germany’s Top-7 cities (Berlin, Dusseldorf, Frankfurt/Main, Hamburg, Cologne, Munich, Stuttgart) are stabilizing and in some cases even rising compared with the previous quarter. The outlier on the downside is Hamburg, where prices are down 3.9 percent. The second sharpest price decline was in Frankfurt, but at minus 0.9 percent this was already quite moderate. In Dusseldorf (+2.9 percent) and Berlin (+1.3 percent), prices for apartments are already rising again.

In Cologne (-0.2 percent) and Stuttgart (-0.4 percent), prices are declining only minimally. Note: No second-quarter data are available for Munich in this Greix update.

Other Cities:

Outside the Top-7 cities, too, the picture is mixed, with apartments becoming even more affordable or already more expensive again, depending on the region. In Erfurt, the increase compared with the previous quarter was quite significant at plus 5.9 percent, followed by Chemnitz at plus 3.4 percent.

In Potsdam (+1.2 percent) and Duisburg (+0.8 percent), sales prices rose only slightly. Significant declines can be observed in Dresden (-1.7 percent) and, above all, Bonn (-2.7 percent) and Wiesbaden (-3.7 percent).

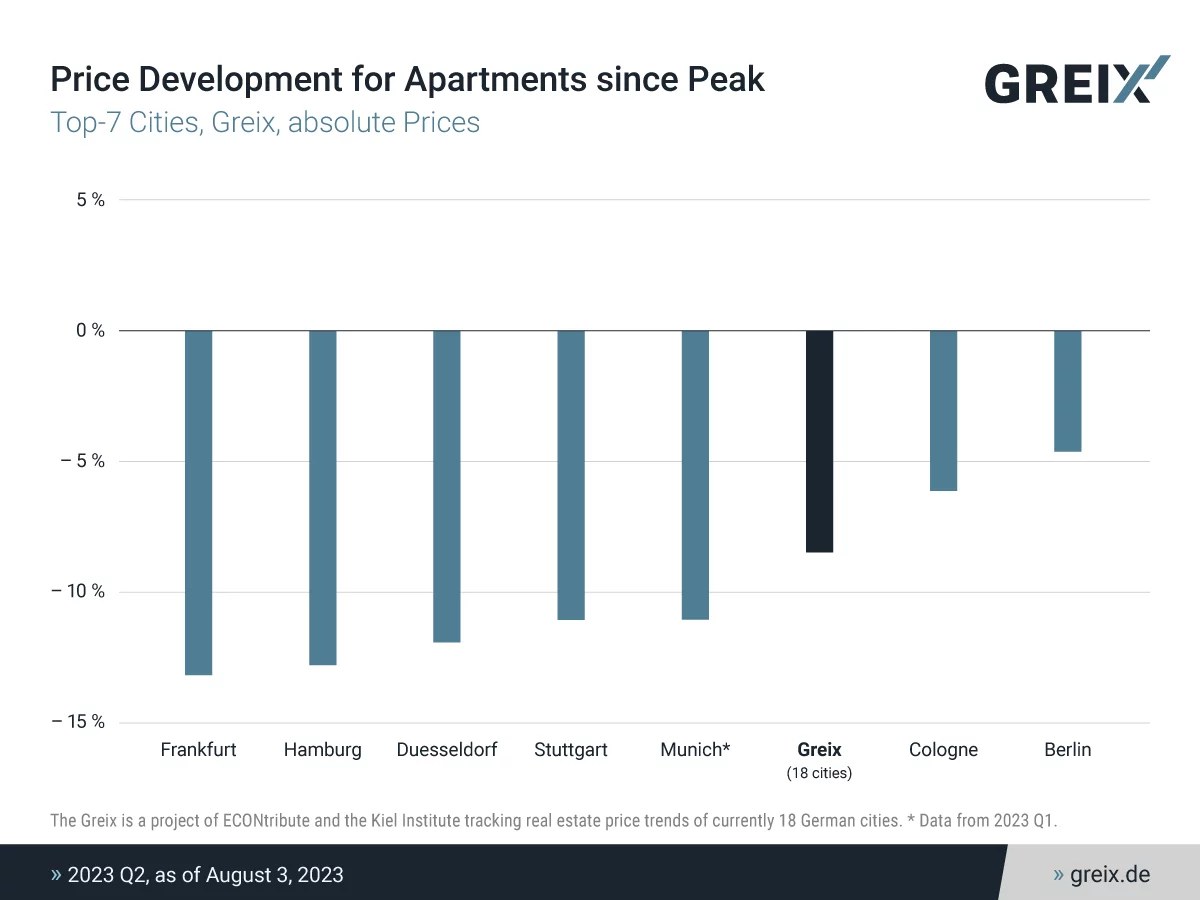

Decline since peak:

Compared with their respective peaks, sales prices for condominiums are all down, both for all cities in the top 7 metropolitan areas and for the Greix itself, i.e. the entirety of the 18 cities surveyed.

The intensity of the price decline is very heterogeneous. In Frankfurt/Main, prices have fallen the most, by more than 13 percent, since their peak in the second quarter of 2022. A similarly strong price decline can be observed in Hamburg. Düsseldorf, Stuttgart and Munich (latest data from Q1/2023) follow with a drop of over 11 percent.

The smallest price declines since the peak have been seen in Cologne, at just over 6 percent, and Berlin, at just under 5 percent.

The Greix price index, which is made up of all 18 cities, recorded a decline of just over 8 percent. This indicates that the price decline outside the top 7 metropolitan areas was less than within, as the Greix price decline is below the average for the top 7 cities.

"The latest figures from Greix show that the price decline in the real estate market is leveling off and that, regionally, prices are even starting to rise again. It remains to be seen whether a turnaround towards rising prices has already been heralded. After a historically unusually strong and rapid price decline such as we have seen, a phase of countermovement is quite normal, which could be followed by renewed price declines," says Schularick.

Data and methods:

The data collection and evaluation takes place in cooperation with the local expert committees. All real estate transactions are recorded in their entirety. Price trends are calculated using the latest scientific standards and statistical methods.